Arch Coal, Inc. Reports Third Quarter 2007 Results

Arch Coal delivers a solid operating performance in improving U.S. coal market

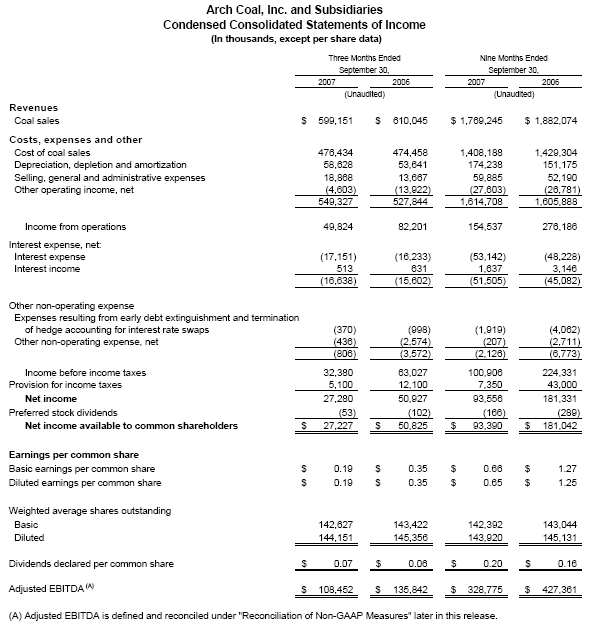

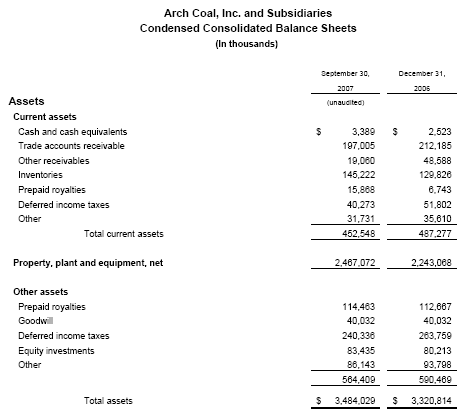

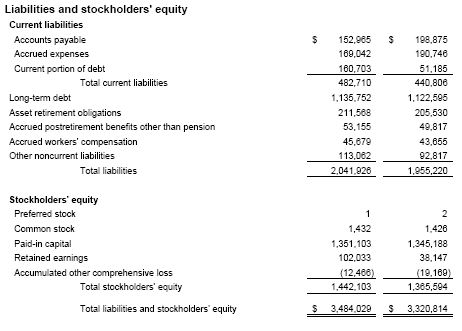

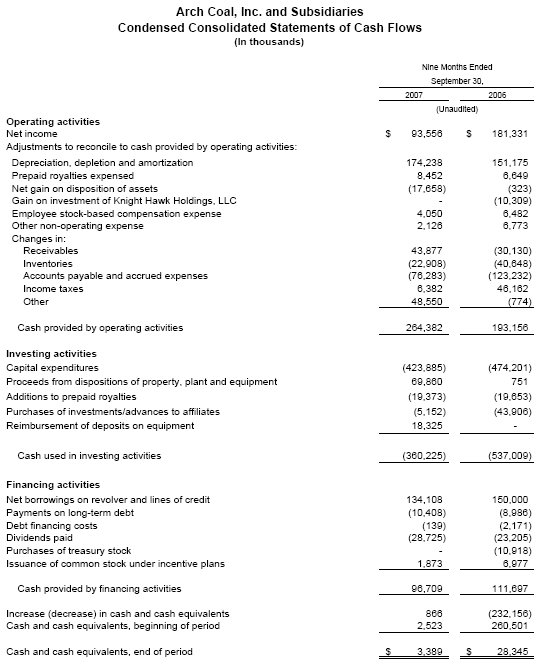

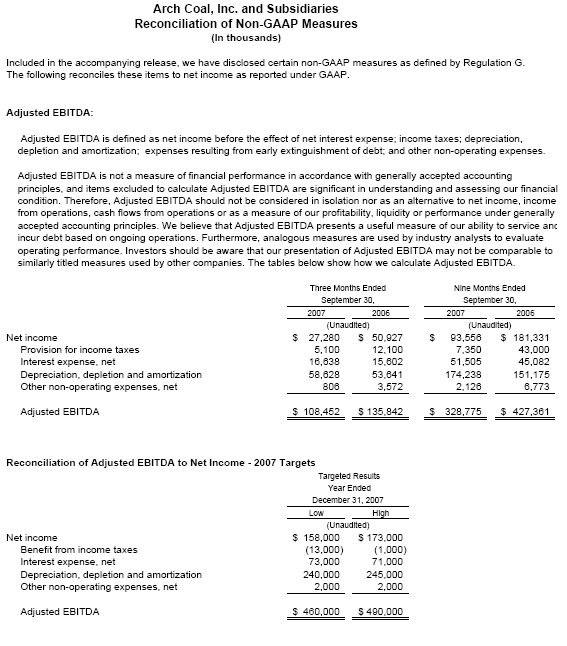

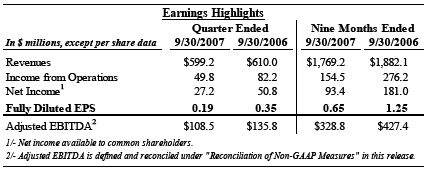

ST. LOUIS (October 19, 2007) – Arch Coal, Inc. (NYSE:ACI) today reported third quarter 2007 net income available to common shareholders of $27.2 million, or $0.19 per fully diluted share, compared with $50.8 million, or $0.35 per fully diluted share, in the prior-year period. Arch recorded income from operations of $49.8 million and adjusted earnings before interest, taxes, depreciation and amortization ("EBITDA") of $108.5 million in the quarter just ended. During the third quarter of 2006, Arch earned $82.2 million of operating income and $135.8 million of adjusted EBITDA.

For the first nine months of 2007, Arch earned net income available to common shareholders of $93.4 million and adjusted EBITDA of $328.8 million. In the prior-year period, when market conditions were appreciably stronger, Arch reported net income available to common shareholders of $181.0 million and adjusted EBITDA of $427.4 million.

"Arch Coal continued to deliver solid operating results during the third quarter of 2007, despite weaker market conditions than in the year-ago period," said Steven F. Leer, Arch's chairman and chief executive officer. "Additionally, Arch completed work on the development of the Mountain Laurel complex in Central Appalachia and made a strategic investment in coal reserves in the Illinois Basin. We are pleased to announce the early start-up of Mountain Laurel's longwall on October 1, and expect output from this mine to increase our participation in international and domestic metallurgical and pulverized coal injection markets in future periods."

"U.S. coal market fundamentals improved during the third quarter, and momentum appears to be increasing as we move through the fourth quarter due to positive trends in key demand and supply factors," continued Leer. "Almost all signs support our view that coal markets will continue to improve throughout 2008. As a result, Arch is committed to following a market-driven strategy, which is in the best interest of our shareholders. We believe our unpriced sales position provides the company with leverage to the upside potential of coal markets, and we expect this leverage to translate into substantial shareholder value as markets strengthen."

Arch Announces the Start-Up of its Mountain Laurel Operation

On October 1, 2007, the longwall at Arch's Mountain Laurel complex in Central Appalachia began production. The company anticipates the complex will produce roughly 0.9 million tons during the fourth quarter of 2007 as the longwall ramps up to full production, with the expectation that the complex will produce between 4 million and 5 million tons in 2008. Arch will focus on placing coal from Mountain Laurel's operation into international and domestic metallurgical coal markets and domestic pulverized coal injection markets, with the flexibility to sell some tonnage into export or domestic thermal markets as opportunities arise.

"The timing for the Mountain Laurel longwall start-up is extremely advantageous given booming world metallurgical markets and stronger export steam markets," said Leer. "U.S. coal exports are likely to grow in 2008 due to tight international supply conditions, as well as global infrastructure and transportation constraints. As a result, we expect international customers to increasingly view U.S. coal supplies as an alternative and diversified supply source. Looking ahead, we expect our Mountain Laurel operation to deliver a very strong return on our investment given its superior geology and strategic access to export markets."

The ramp-up of production at Mountain Laurel began earlier than anticipated due to the successful start of the newly installed longwall, preparation plant and loadout facility at the complex. The new operation will more than replace production from Arch's depleted longwall mine at the Mingo Logan Ben Creek complex, which contributed approximately 1 million tons during the first half of 2007 prior to being sold at the end of June. Additionally, Mountain Laurel's low-cost reserve base is expected to benefit Arch's competitive cash cost structure in Central Appalachia in future periods.

Arch Adds Coal Reserves in the Illinois Basin

In September 2007, Arch acquired approximately 157 million tons of recoverable coal reserves and significant surface acreage in the Illinois Basin from International Coal Group, Inc. for $38.9 million. This acquisition expands Arch's footprint in Illinois and gives the company control of more than 375 million tons of coal reserves in the region. Additionally, synergies with Arch's existing reserve base have created a nearly 300-million-ton continuous reserve block of high-quality, low-chlorine bituminous coal well suited for scrubbed power generation units.

"This strategic acquisition further enhances Arch's substantial reserve position in Illinois, a market where Arch previously had a long and successful history," said Leer. "Additionally, the transaction will allow Arch to build a low-cost platform for future growth in the region. We expect the Illinois Basin to play a more significant role in U.S. energy markets over the next decade, and envision that Arch's expanded position in the region would eventually support a mine development for the domestic utility market or a coal-to-liquids facility, depending on future market conditions."

Arch's Operations Continue to Deliver a Solid Performance

"Our operations continued to perform well during the third quarter of 2007, reflecting our ongoing ability to manage through downturns in U.S. coal markets," said John W. Eaves, Arch's president and chief operating officer. "We held the line on operating costs, and I'm pleased to highlight the decline in our cash costs in Central Appalachia to under $40 per ton for the third quarter."

"Looking ahead, we will continue to place an emphasis on production flexibility and cost control at our operations," continued Eaves. "These initiatives, coupled with improving market conditions, should help to drive even stronger future operational performance."

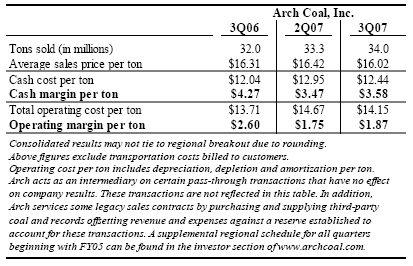

Consolidated average sales price per ton declined $0.40 in the third quarter of 2007 when compared with the second quarter, primarily reflecting a larger mix of Powder River Basin volume. Consolidated average sales price per ton also was impacted by the sale of Mingo Logan's Ben Creek complex at the end of June, which lowered volume and price realization contributions from Central Appalachia during the third quarter of 2007. Consolidated operating cost per ton declined $0.52 in the third quarter of 2007 when compared with the prior-quarter period, benefiting from changes in the company's overall production mix and cost control efforts. As a result, Arch's consolidated operating margin expanded to $1.87 per ton in the third quarter of 2007 compared with $1.75 per ton in the prior-quarter period.

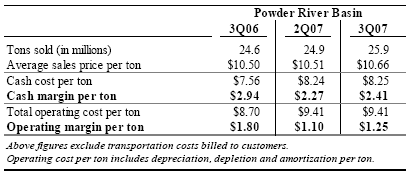

In the Powder River Basin, Arch's third quarter 2007 volumes increased slightly when compared with the prior quarter period due to more favorable weather conditions and rail performance when compared with the first half of 2007, as well as increased brokerage activity. Average sales price per ton increased $0.15 in the third quarter of 2007 when compared with the second quarter, benefiting from higher pricing on Arch's contract portfolio due to the increased value of sulfur dioxide emission allowances, and higher pricing on market index-priced tons. Third quarter 2007 per-ton operating costs in the Powder River Basin remained flat despite commodity cost pressures, resulting in the expansion of operating margin to $1.25 per ton compared with $1.10 per ton in the second quarter of 2007.

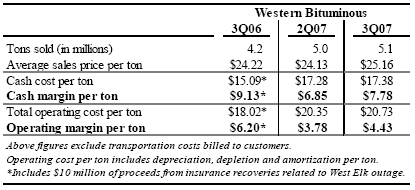

In the Western Bituminous region, average sales price per ton increased $1.03 in the third quarter of 2007 when compared with the second quarter, benefiting from a more favorable sales contract mix and higher pricing on Arch's contract portfolio due to the increased value of sulfur dioxide emission allowances. Operating costs per ton increased $0.38 over the same time period, in part due to increased production from Arch's higher cost mines in the region. Arch's third quarter 2007 per-ton operating margin in the Western Bituminous region expanded to $4.43 compared with $3.78 in the prior-quarter period.

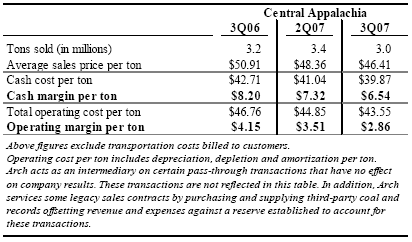

In the Central Appalachian region, Arch's third quarter 2007 volumes declined 0.4 million tons when compared with the prior quarter period due to the sale of the aforementioned Mingo Logan Ben Creek complex at the end of June. Average sales price per ton declined $1.95 in the third quarter of 2007 when compared with the second quarter as a result of lower metallurgical coal sales stemming from the sale the Ben Creek operation. Operating costs per ton declined $1.30 over the same time period, benefiting from the divestiture of Arch's highest-cost mine in the region and from strong cost performances at Arch's current mine portfolio. Beginning in the fourth quarter, Arch's regional analysis will reflect the impact of its Mountain Laurel longwall mining complex.

Arch Looks Ahead to Stronger U.S. Coal Markets in 2008

International metallurgical and thermal coal markets are robust, as evidenced by recent seaborne thermal trades that have crossed the $120 per metric ton mark for delivery into northern Europe. Key drivers of higher seaborne coal prices include increased steel demand and higher steam coal consumption in developing nations, particularly Asia, as well as supply, infrastructure and transportation constraints in traditional export nations.

There is evidence to suggest that U.S. coal markets are already responding to the tightness experienced in international coal markets. Arch estimates that U.S. coal import growth was stagnant year-to-date through August 2007, as supply has been diverted into the higher-priced seaborne trade. Over the same time frame, U.S. coal export growth has increased by more than 6 million tons, and is expected to grow throughout the remainder of this year and into next year.

On the domestic demand side, U.S. electric generation demand increased 2.9 percent year-to-date through the second week of October 2007, according to statistics compiled by the Edison Electric Institute. In fact, average monthly electric output, as measured in millions of kilowatt-hours, was particularly strong in August and September 2007 – up more than 3.8 percent and 8.5 percent, respectively – driven by warmer-than-normal temperatures. Arch estimates that coal consumption for power demand in the electric power sector reached an all-time monthly record of close to 100 million tons in August, and believes that final September coal consumption figures for electricity generation will set a record in that month as well.

On the supply-side, coal production has declined approximately 13 million tons year-to-date through the second week of October 2007, according to government estimates. The primary driver of this decline is production shortfalls in Central Appalachia, where volume was down by close to 9 million tons through the first 41 weeks of the year. Looking ahead, Arch continues to expect significant regulatory hurdles in Central Appalachia to constrain production in that region.

Consequently, Arch believes that U.S. generator coal stockpile levels have declined to roughly 135 million tons at the end of September 2007, which is below the level at which the year began. On an annualized days supply basis, which does not reflect seasonality, Arch estimates that generators had approximately 47 days of supply available in stockpiles at September 30, which is four days above the five-year annualized average of 43 days.

"The positive drivers contributing to strength in international coal markets are likely to have a spillover effect into domestic coal markets," said Leer. "We have already seen coal pricing in Appalachia increase in response to these dynamics, and expect further price appreciation across all domestic coal regions as we move into 2008."

Over the long-term, Arch remains positive on U.S. coal market fundamentals. Since the last update, Arch estimates that at least 14 gigawatts of new coal-fueled capacity are now under construction in the U.S., representing the addition of roughly 50 million tons of annual coal demand. These identified plants will be phased in over the next four years, with more than 85 percent of the capacity online by the end of 2010. Furthermore, more than 5 gigawatts – representing close to 20 million tons of incremental annual coal demand – are currently in advanced stages of development. Arch expects the majority of these plants to be built during the next five years.

"We're pleased with the recent progress on these new coal-based units," continued Leer. "These capacity additions are the right decision for the country, as they will benefit American consumers by giving them access to affordable, reliable and secure energy sources for decades to come."

Arch Selectively Adds to Sales Contract Portfolio

Since last quarter, Arch selectively signed sales commitments totaling approximately 5 million tons across the company's operating regions for 2008 and 2009 delivery, at prices that significantly exceeded average realized pricing during the third quarter of 2007. Additionally, in recent weeks, Arch has successfully placed initial volumes out of its new Mountain Laurel operation into the export and domestic metallurgical coal markets, as well as the domestic pulverized coal injection markets, for 2008 delivery at very advantageous pricing. Additional near-term business has been placed in the export thermal markets at premiums to domestic thermal markets.

"We're pleased with the pricing levels achieved on our committed tonnage during the third quarter and are clearly excited about the successful start to the Mountain Laurel operation," said Eaves. "We continue to follow a market-driven strategy, which focuses on achieving a sufficient return for all of our valuable coal reserves. Given our expectation for improving U.S. coal market fundamentals, we believe that maintaining a significant unpriced position at this time is advantageous for Arch and our shareholders. In fact, increases in coal index reference pricing since the first half of 2007 have served to further validate this strategy."

At present, Arch has unpriced volumes of less than 2 million tons for 2007 delivery; between 45 million and 55 million tons for 2008 delivery; and between 100 million and 110 million tons for 2009 delivery.

Arch Celebrates Key Safety and Environmental Awards

Arch's Band Mill No. 2 mine, part of the Cumberland River mining complex in Central Appalachia, was honored with the U.S. Department of Labor's prestigious Sentinels of Safety award as the nation's safest underground mine in 2006. This recognition marks the second year in a row that an Arch subsidiary has been awarded the highest national safety award in the large underground mining category. Arch's Skyline mine in Utah earned the 2005 Sentinels of Safety award last year.

Additionally, two of Arch's subsidiaries were honored with environmental and corporate citizenship awards during the third quarter of 2007. Arch's Holden 22 mine, part of Coal-Mac's operations in Central Appalachia, was recognized by the U.S. Department of the Interior for demonstrating the best reclamation and stewardship practices in the past year. Additionally, Arch's Mountain Laurel mining complex was recognized by the U.S. Department of the Interior for its exemplary interaction, communication and involvement with the surrounding communities. Mountain Laurel is the third Arch Coal subsidiary in four years to earn a national Good Neighbor Award since the award was created in 2003.

"We're proud of the accomplishments earned by our employees, which exemplifies Arch's commitment in key areas of safety, environmental excellence and corporate citizenship," said Leer. "These areas are the building blocks upon which Arch's reputation and legacy in the communities in which we operate are built."

Arch Tightens Guidance Range for 2007

Arch now expects total sales volume for 2007 to be between 128 million to 133 million tons, which includes additional brokerage opportunities in the second half of 2007 as well as the early start-up of Mountain Laurel. This sales range also excludes approximately 3 million tons of pass-through activity. Earnings per share for 2007 is now projected to be within the range of $1.10 per share to $1.20 per share, while adjusted EBITDA is expected to be in the $460 million to $490 million range. Furthermore, capital spending levels are now expected to total approximately $250 million, exclusive of reserve additions, and depreciation, depletion and amortization expense is expected to range between $240 million to $245 million.

"We expect a strong finish in 2007 with the successful start-up of Mountain Laurel," said Leer. "This year has been transitional for Arch's Central Appalachian operations, as we persevered through challenging mining conditions in the final longwall panels at our Mingo Logan Ben Creek complex during the first half of the year, and overcame a 'gap' in operations during the third quarter created by the sale of this mine at the end of June."

"In 2008, we expect to more than double Arch's metallurgical coal sales capabilities, aided by the addition of Mountain Laurel," continued Leer. "Arch's ability to tap into robust seaborne and domestic met coal markets is a major focus of the company as we enter next year."

"Arch is particularly well-positioned to capitalize on improving market fundamentals given our size, diversity of operations, extensive low-sulfur reserve base and our meaningful uncommitted sales position," added Leer. "We believe that strong demand pull and ongoing supply constraints around the world will continue to exert upward pressure on coal prices. Arch is strategically capable of supplying these improving markets and leveraging our superior low-cost asset base to create substantial value for our shareholders over the long-term."

A conference call regarding Arch Coal's third quarter 2007 financial results will be webcast live today at 11 a.m. E.D.T. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com)

St. Louis-based Arch Coal is one of the nation's largest coal producers. The company's core business is providing U.S. power generators with clean-burning, low-sulfur coal for electric generation. Through its national network of mines, Arch supplies the fuel for approximately 6 percent of the electricity generated in the United States.

Forward-Looking Statements: This press release contains "forward-looking statements" – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission.