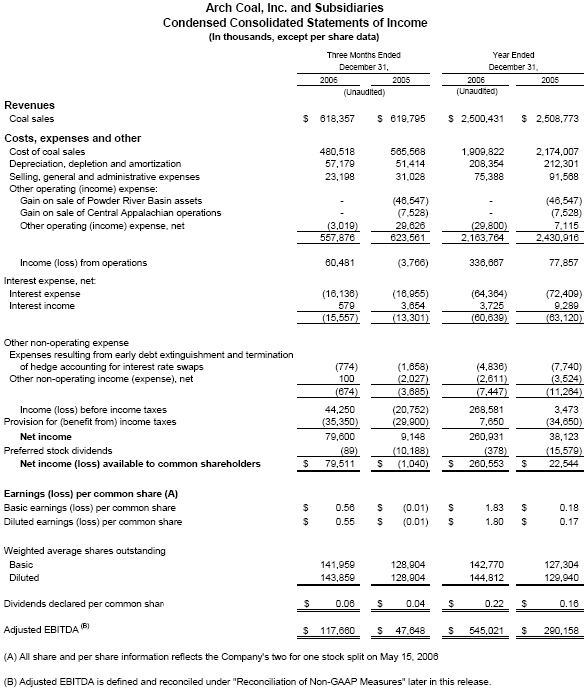

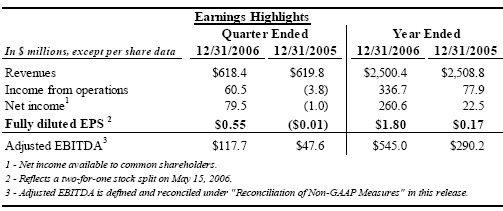

Arch Coal, Inc. Reports Record Full Year 2006 Results

EPS increases to $1.80 from $0.17 in prior-year period

Net income1 increases to $260.6 million vs. $22.5 million in 2005

EBITDA improves 88% to $545.0 million vs. $290.2 million a year ago

St. Louis (February 2, 2007) - Arch Coal, Inc. (NYSE: ACI) today reported record 2006 net income available to common shareholders of $260.6 million, or $1.80 per fully diluted share, compared with $22.5 million, or $0.17 per fully diluted share, in 2005. Income from operations more than quadrupled to $336.7 million and adjusted EBITDA nearly doubled to $545.0 million when compared with 2005. Additionally, revenues were flat on a year-over-year basis, due to the 2005 sale of select operations in Central Appalachia, which affected the comparability of results.

"Arch Coal achieved record results in 2006, with significant growth in our key earnings metrics," said Steven F. Leer, Arch's chairman and chief executive officer. "We have improved on virtually every financial measure, including operating income, earnings per share and adjusted EBITDA. Looking ahead, Arch remains focused on managing our business through the near-term weakness in the U.S. coal markets, while strongly positioning the company to capitalize on expected growth in coal demand later this year and beyond."

In the fourth quarter of 2006, Arch posted earnings per fully diluted share of $0.55 compared with a loss of $0.01 in the prior-year period. Income from operations improved significantly, reaching $60.5 million in the quarter just ended compared with a $3.8 million loss in the fourth quarter of 2005. Adjusted EBITDA more than doubled in the fourth quarter of 2006, increasing to $117.7 million from $47.6 million in the prior-year period.

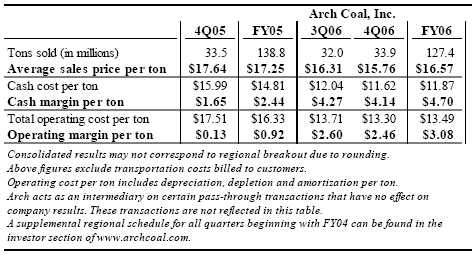

Arch Increases Operating Margin per Ton in All Regions

Consolidated operating results were impacted by the sale of select Central Appalachian operations in December 2005, affecting volume and price realization comparability. Consolidated operating margin per ton improved dramatically, totaling $3.08 in 2006 compared with $0.92 in 2005. "Higher price realizations on retained operations, coupled with the success of our process improvement initiatives, served to increase profitability at our mines in 2006," said John W. Eaves, Arch's president and chief operating officer. "Going forward, we will remain focused on controlling costs while maintaining production flexibility in response to weak market conditions."

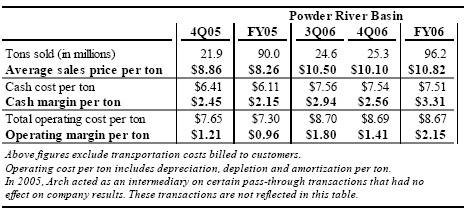

In the Powder River Basin, sales volume increased 3.4 million tons in the fourth quarter of 2006 compared with the fourth quarter of 2005, driven by the restart of Coal Creek as well as improving rail service during the second half of last year. In 2005, Arch experienced significant rail disruptions resulting from major maintenance and repair work. Similar repair and construction work continued in 2006, the impact of which was less severe than in 2005. For the fourth quarter of 2006, average price realization increased $1.24 per ton over the prior-year period, reflecting the roll-off of lower-priced sales contracts. Operating margin per ton averaged $1.41 in the fourth quarter of 2006, a 16.5 percent increase over the prior-year period.

Sales volume increased to 25.3 million tons during the fourth quarter of 2006, a 2.8 percent increase over the third quarter of 2006, benefiting partially from improving rail service at Arch's Black Thunder mine. Average price realization for this region declined $0.40 per ton against the prior-quarter period, driven by contract mix and volumes tied to market-based pricing. Operating costs for the fourth quarter of 2006 remained generally stable compared with the prior-quarter period.

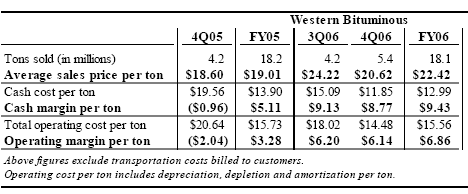

In the Western Bituminous Region, sales volume increased 1.2 million tons in the fourth quarter of 2006 compared with the fourth quarter of 2005, reflecting the longwall outage at West Elk in the fourth quarter of 2005 and the start-up of the Skyline mine in the first half of 2006. Average price realization rose by $2.02 per ton in the fourth quarter of 2006 compared with the prior-year period, resulting from the continued roll-off of lower-priced sales contracts. Operating margin per ton averaged $6.14 in the quarter just ended, benefiting partially from an $11.9 million insurance recovery at West Elk. This recovery finalizes the insurance claim for the spontaneous combustion event at West Elk, representing a total recovery of $41.9 million for the year. During the fourth quarter of 2005, operating margin per ton was impacted by West Elk's mine outage.

Compared with the third quarter of 2006, sales volume increased 1.2 million tons, reflecting full operational run rates at each of the region's mines. Average price realization declined $3.60 per ton compared with the prior-quarter period as additional tons of certain lower-priced legacy contracts were shipped to meet annual customer obligations. Some of these shipments were pushed to the fourth quarter due to the West Elk outage and the extended longwall move at Dugout Canyon during the first and third quarters of 2006, respectively. Operating costs in both the third and fourth quarter of 2006 benefited from insurance recovery settlements related to West Elk. Despite the decline in average price realization, operating margins remained relatively steady quarter over quarter due to the strong cost performance exhibited at all of the mines in this region for the quarter just ended.

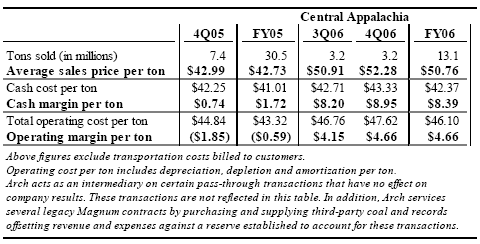

In Central Appalachia, volume comparisons were impacted by the divestiture of select operations in December 2005. Average price realization rose by $9.29 per ton in the fourth quarter of 2006 compared with fourth quarter of 2005. Operating margin improved substantially over the same time period, reflecting the continued roll-off of lower-priced sales contracts as well as the divestiture of select operations in this region.

Compared with the third quarter of 2006, average price realization increased $1.37 per ton, benefiting from a slightly larger percentage of metallurgical coal sales in the fourth quarter and the continued roll-off of lower priced sales contracts. Operating costs in the fourth quarter of 2006 increased $0.86 per ton. This increase resulted from an adjustment in the value of coal inventory at Arch's river terminal in Kentucky associated with recent market weakness in the region.

Operating margin averaged $4.66 per ton in 2006 compared with a loss of $0.59 per ton in 2005. "Our margin expansion came in at the high end of our targeted range of $3 to $5 per ton," said Eaves. "Arch effectively managed waning market conditions throughout the year and achieved a solid operating performance in Central Appalachia."

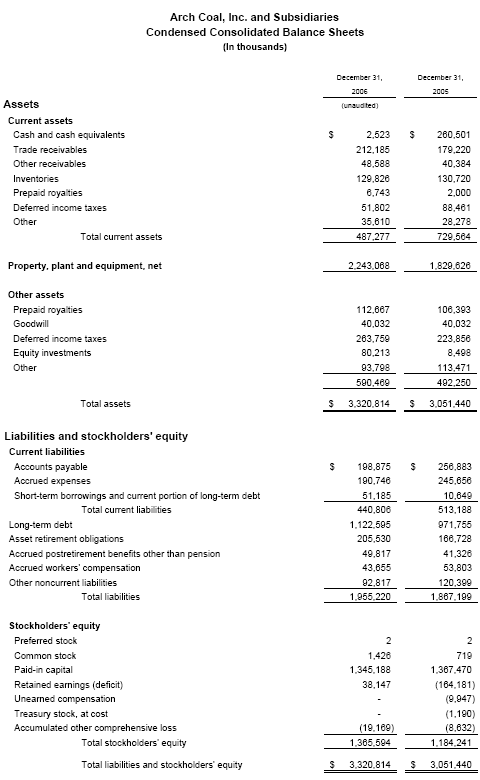

Arch Makes Select Financial Decisions in 2006 to Enhance Shareholder Value

During the fourth quarter of 2006, Arch repurchased 712,400 of its common shares outstanding at an average price of $28.06. Since launching the 14-million-share common stock repurchase program in September 2006, Arch has repurchased a total of 1.6 million shares. These repurchases were funded by a combination of operating cash flows and revolver borrowings.

In April 2006, Arch announced a 50 percent increase in the dividend rate on its common stock. Arch also completed a two-for-one stock split on May 15, 2006. Additionally, in the first half of 2006, the company commenced a $150 million accounts receivable securitization program designed to offer an additional source of low-cost liquidity.

Arch Maintains Focus on Core Values

Arch has a long-standing commitment to safety, evidenced by 10 national and state safety awards earned in 2006. Arch's Skyline mine in Utah was honored with the U.S. Department of Labor's Sentinels of Safety award as the nation's safest underground mine. During 2006, Arch achieved an overall safety record that was three times better than the national coal industry average based on the most recently available industry data, and its second best year on record as measured by its lost time incident rate.

Additionally, Arch worked aggressively during 2006 to extend its productivity advantage, including operating the nation's most productive longwall mine - Sufco in Utah - according to the most recent industry data. In fact, Arch estimates that three of the top eight most productive longwall mines in the U.S. last year were company owned operations. Furthermore, Arch's surface operations were three times more productive than the industry average, according to the most recent data available.

Arch continued to excel in the environmental arena, earning the U.S. Department of the Interior's National Good Neighbor award and the top West Virginia award for land reclamation for the fifth time in the last six years. During 2006, Arch also received five other national or state distinctions for excellence in land reclamation, wildlife habitat protection and community service.

"We are proud of the accomplishments in each of Arch's three pillars of performance - safety, productivity and environmental stewardship," said Leer. "These core values provide the foundation for our singular goal of creating long-term shareholder value in the years to come."

Arch Further Reduces Production Targets Based on Near-Term Market Conditions

Given current weakness in the U.S. coal markets, Arch has elected to further reduce its production target for 2007, and now expects to produce between 130 million and 135 million tons for the full year.

"Based on current market demand, we are confident that leaving more tons in the ground is the right decision," Leer said. "By doing so, we are preserving the value of our low-cost reserves for future periods, when we expect market demand to be stronger."

Leer added that it is apparent that the market does not require the additional tons. "We believe it would be a mistake to force additional tons into a market that is currently oversupplied, particularly when the underlying long-term market fundamentals continue to be very strong," he said.

With the planned production cuts and the signing of a number of commitments during the fourth quarter of 2006, Arch now has approximately 11 million to 16 million tons of 2007 expected production that has yet to be priced.

During the fourth quarter of 2006, Arch signed coal commitments of approximately 15 million tons for 2007 delivery and approximately 5 million tons for 2008 delivery at prices that on average exceeded - and in many instances significantly exceeded - the company's average realized pricing for the fourth quarter in the respective basins in which the coal was committed.

Based on current expected production over the next two years, the company has unpriced volumes of between 75 million and 85 million tons in 2008 and between 110 million and 120 million tons in 2009. "Arch expects coal demand to rebound given normal growth in electricity generation as well as growth from new generation demand, a meaningful percentage of which is expected to come online by the end of the decade," said Leer. "Additionally, expected production rationalization in eastern coalfields should benefit coal markets going forward."

Arch Remains Bullish on the U.S. Coal Industry Long-Term

Coal markets weakened in 2006 as mild weather patterns, better than expected performance by competing fuels, increased coal production and a rebuild in generator coal stockpile levels all contributed to dampen coal prices. Arch estimates that coal consumption for power generation declined 0.9 percent last year, driven by an overall reduction in electric generation demand. At the same time, gross domestic product rose by 3.4 percent in 2006 based on recently reported government data. This anomaly of a growing economy and declining coal consumption has occurred only four times in the past 56 years.

Arch estimates that generator coal stockpiles reached 136 million tons in December 2006, representing a 47-day supply, which is above the historical five-year average. Nationally, coal production was up an estimated 26 million tons through December 2006, while coal consumption declined by an estimated 10 million tons over the same time period based on MSHA and EIA estimates. However, production run rates in several key coal supply regions, including Central Appalachia, declined meaningfully throughout the four quarters of 2006.

Looking beyond the near-term market pressures, Arch strongly believes in the long-term fundamental outlook of the U.S. coal industry. More normal weather patterns, coupled with production rationalization in Central Appalachia, could help to ameliorate the supply and demand imbalance of 2006. Additionally, planned new domestic coal-fueled capacity announcements have reached 96 gigawatts to date, equating to more than 300 million tons of annual coal demand. Arch estimates that approximately 15 gigawatts of generating capacity is currently under construction or in advanced stages of development with completion expected by 2010, which could translate into nearly 60 million tons of incremental coal demand over that time frame. Another 15 gigawatts of announced generating capacity appears to be gaining traction as well. Demand growth from new facilities represents a key component in the favorable long-term outlook for coal.

Additionally, public interest in domestic energy security continues to favor the adoption of coal conversion and other clean-coal technologies. Growing Congressional support is focusing attention on alternative fuel sources including coal-to-liquids. Several industry projects are progressing, including DKRW Advanced Fuel's proposed coal-to-liquids facility. Arch owns a 25 percent interest in DKRW Advanced Fuels and Arch's Carbon Basin coal reserves in Wyoming would serve as feedstock for the potential plant. The advancement of coal-conversion technologies represents a positive long-term development for coal.

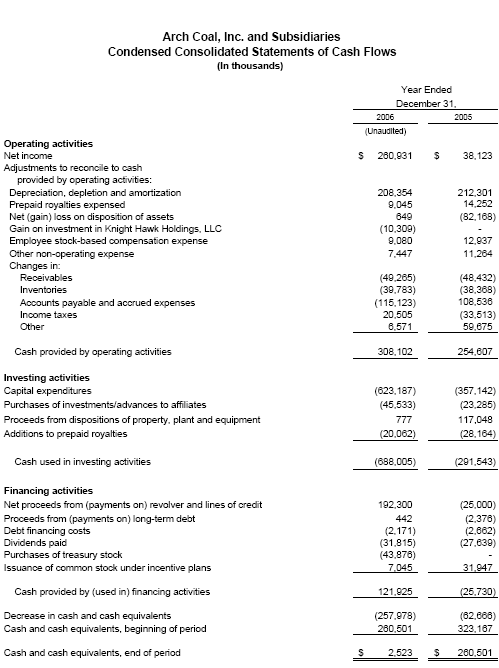

Arch Targets Lower Capital Spending in 2007

In 2006, Arch completed two of three major expansion projects - the re-opening of the Coal Creek surface mine in the Powder River Basin and the addition of the Skyline underground mine in the Western Bituminous Region. "The addition of Coal Creek and Skyline to our portfolio of mines was a highlight for Arch this year," said Leer. "We believe the restart of these highly competitive low-cost mines - at relatively low capital costs - further enhances our strong competitive position and should deliver significant value for the company in future periods."

Arch also made considerable progress on the development of the Mountain Laurel complex in Central Appalachia. This strategic asset will become the centerpiece of this region's operations by 2008. During the fourth quarter of 2007, the production from the start-up of the longwall at Mountain Laurel's underground mine is expected to replace the production from the depleting longwall at Mingo Logan. Arch anticipates that Mountain Laurel's costs will be substantially lower than Mingo Logan's, and that this transition will lower overall operating costs at its Central Appalachian operations. Mingo Logan will continue as a continuous miner operation, with targeted production of approximately 1 million tons per year.

Arch is proactively reducing its discretionary capital spending in the current market environment, and is now targeting total capital spending, excluding reserve additions, of between $240 million and $280 million in 2007. This reduced level of capital expenditures follows a peak year that encompassed spending for three organic growth projects. "Despite the very attractive long-term outlook for U.S. coal, we believe it is simply good business to align capital spending levels with the current soft market environment and our reduced planned production levels," said Eaves.

Included in the 2007 capital spending forecast is approximately $110 million for the completion of the Mountain Laurel underground mine. In addition, the company expects to invest approximately $25 million this year as part of the cost of replacing the south rail loadout at Black Thunder. As previously announced in the fourth quarter of 2005, Arch completed a reserve swap and sold its south loadout, rail spur and an idle office complex for $85 million. As part of this transaction, Arch signed an exclusive lease on the loadout facility that expires in October 2008.

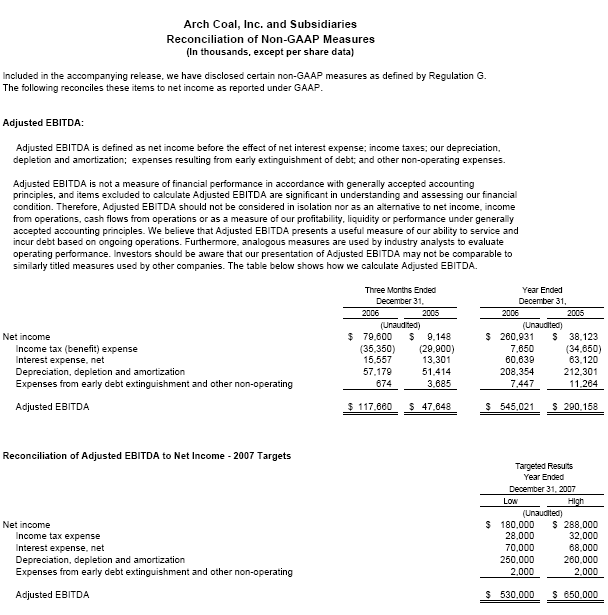

Arch Provides Earnings Outlook for 2007

Arch has set its guidance for full year 2007 as follows:

- Reflecting the near-term market conditions and the steps to match our anticipated production to market requirements, Arch currently expects fully diluted earnings per share to be between $1.25 and $2.00. Arch's actual results ultimately will be significantly influenced by the market demand requirements, the company's final production levels in 2007, and the pricing Arch achieves on its remaining unpriced tons.

- Adjusted EBITDA is expected to be in the $530 million to $650 million range.

- Sales volume is expected to be 130 million to 135 million tons, excluding 2 million pass-through tons that Arch currently services from the 2005 sale of select Central Appalachian operations.

- Capital expenditures are projected to be between $240 million and $280 million.

- Depreciation, depletion and amortization is expected to be between $250 million and $260 million.

- Arch's tax rate is projected to be approximately 10 percent to 13 percent.

"We believe the correction in the U.S. coal markets to be short-term in nature," said Leer. "Nonetheless, Arch is taking proactive steps to rationalize production targets, contain costs, execute process improvement initiatives and optimize return on capital. We have worked hard to reorient our mines over the past few years to maintain the flexibility to meet demand and still run efficiently."

Given the current market conditions, including weather-related shipping problems in January, Arch expects the first quarter of 2007 to be particularly challenging. "Consequently, we expect the first quarter to be our weakest operating period of the year, with Arch's profitability to be slightly above break-even," said Leer.

"Our value-driven market strategy has compelled us to curtail production in lieu of oversupplying a weak market," said Leer. "Arch is sharply focused on managing the business to create long-term value for shareholders. We believe that greater value is achieved by meeting market needs rather than by forcing unwanted coal into the market. As such, we are committed to making the right decisions in 2007 in order to retain upside potential in the years ahead."

"This strategy is driven by our strong belief in the long-term fundamentals of the U.S. coal markets," continued Leer. "Increased energy consumption around the world is fueling the need for additional power generation and coal is the least expensive and most abundant resource available to meet that need. In addition, the significant level of investment in new coal-fueled generator capacity represents a key avenue for demand growth going forward. Moreover, policies that favor the adoption of clean-coal technologies to promote America's energy security are gaining traction. Over the long term, Arch expects our size, unique asset portfolio, talented workforce and low-cost operations to enable us to capitalize in a meaningful way on these future growth opportunities."

A conference call regarding Arch Coal's fourth quarter and annual 2006 financial results will be webcast live today at 11 a.m. EST. The conference call can be accessed via the "investor" section of the Arch Coal Web site (http://investor.archcoal.com).

St. Louis-based Arch Coal is the nation's second largest coal producer. The company's core business is providing U.S. power generators with clean-burning, low-sulfur coal for electric generation. Through its national network of mines, Arch supplies the fuel for approximately 6 percent of the electricity generated in the United States.

Forward-Looking Statements: This press release contains "forward-looking statements" - that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; from future integration of acquired businesses; and from numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. For a description of some of the risks and uncertainties that may affect our future results, you should see the risk factors described from time to time in the reports we file with the Securities and Exchange Commission.