Arch Coal, Inc. Reports Second Quarter Results

Arch Coal, Inc. Reports Second Quarter Results

July 26, 2004 at 3:37 AM EDT

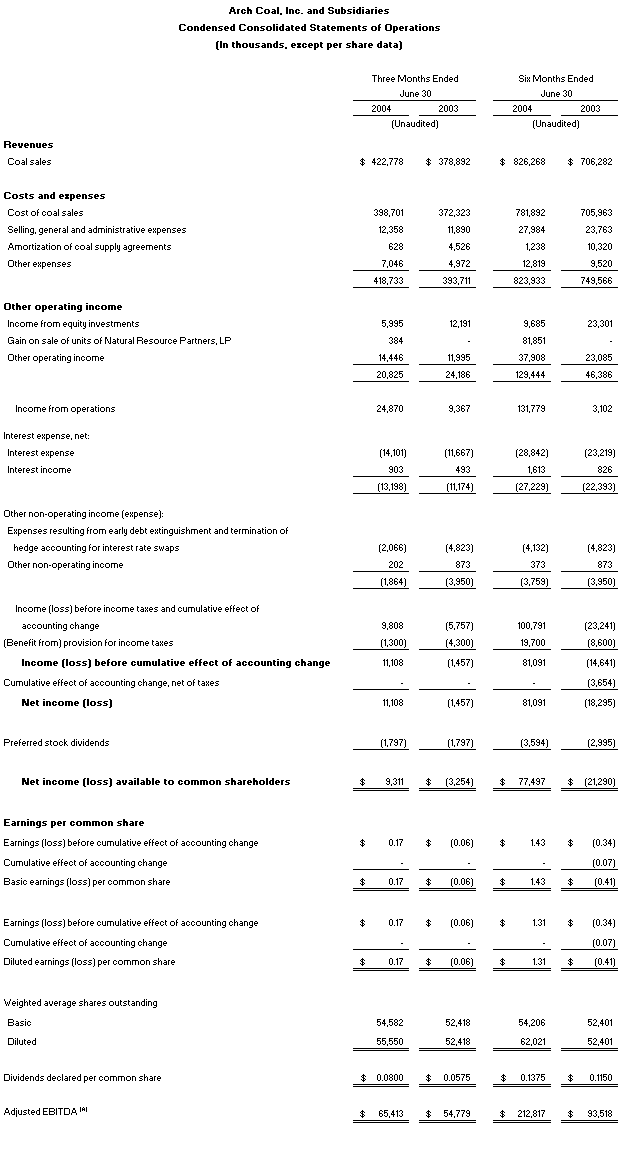

- Revenue increases to $422.8 million, up 12% vs. the same period last year

- Earnings per fully diluted share rises to $0.17 ($0.20 excluding swap-related charge), vs. a net loss in 2Q03

- Adjusted EBITDA increases 19% to $65.4 million

- Average margin increases to $1.45 per ton vs. $0.88 in 2Q03

- Secured all major permits for new longwall mine in Logan County, West Virginia

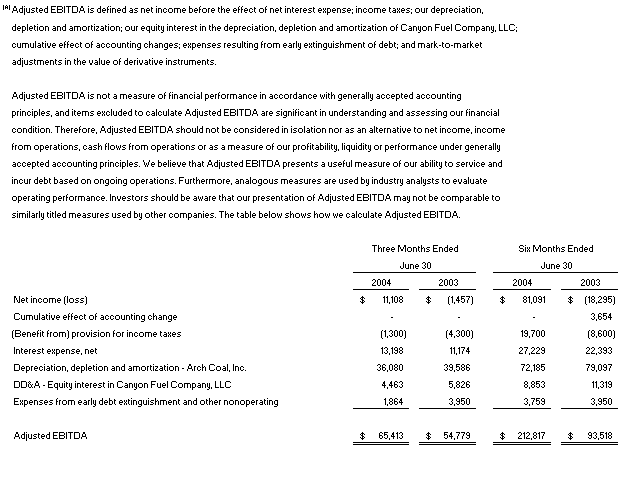

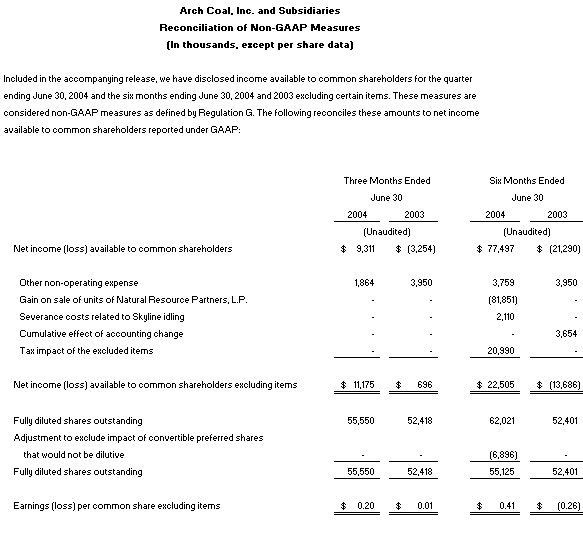

St. Louis - Arch Coal, Inc. (NYSE:ACI) today reported that for its second quarter ended June 30, 2004, it had income available to common shareholders of $9.3 million, or $0.17 per fully diluted share. Excluding charges related to the termination of hedge accounting for interest rate swaps, income available to common shareholders totaled $11.2 million, or $0.20 per fully diluted share. During the same period of 2003, Arch recorded a net loss available to common shareholders of $3.3 million, or $0.06 per fully diluted share. Excluding special items of $4.0 million principally related to the early extinguishment of debt, Arch had income available to common shareholders of $0.7 million, or $0.01 per fully diluted share, during the 2003 quarter.

"During the quarter, Arch reported dramatically improved results due to higher average sales realizations, growing premiums for its low-sulfur coal, and overall strengthening in U.S. coal demand," said Steven F. Leer, Arch's president and chief executive officer. "If not for previously disclosed disruptions in rail service at several of our operations, Arch's results would have been even stronger. In total, missed shipments and production curtailments related to high inventory levels cost the company an estimated $8 million during the period."

Revenues increased 12% for the quarter to $422.8 million, compared to $378.9 million during the same period last year, due to stronger realizations in both the East and West. Sales volumes increased 3% to 26.4 million tons, reflecting an increase of 1.5 million tons, or 8.7%, at Arch's western operations, but offset somewhat by a decline of 0.8 million tons, or 9.6%, in the East. Operating income for the second quarter totaled $24.9 million, which was nearly three times higher than the $9.4 million recorded during the same period last year. Adjusted EBITDA increased 19% to $65.4 million, compared to $54.8 million in the same period last year.

For the six months ended June 30, 2004, income available to common shareholders increased to $22.5 million, or $0.41 per fully diluted share, excluding a net gain of $81.9 million associated with the sale of nearly all of its remaining interest in Natural Resource Partners, charges related to the termination of hedge accounting for interest rate swaps, and severance costs associated with the closing of the Skyline Mine in Utah. That compares to a loss of $13.7 million, or $.26 per fully diluted share, excluding charges related to early debt extinguishment and the cumulative effect of accounting change, during the same period of 2003. Total coal sales for the six months increased 17% to $826.3 million and coal sales volumes increased 8% to 52.3 million tons, vs. $706.3 million and 48.3 million tons in the comparable period of 2003. Adjusted EBITDA totaled $212.8 million for the first six months of 2004, compared to $93.5 million for the same period of 2003.

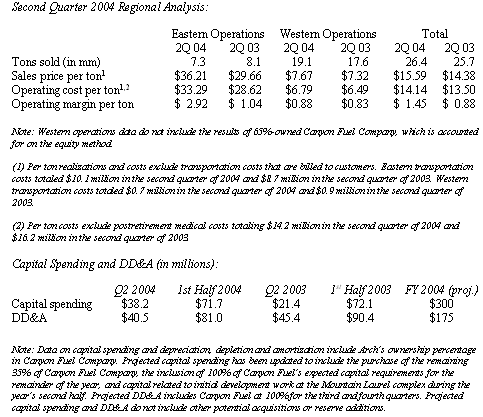

Improving profit margins in both East and West

For the quarter, Arch's average per-ton operating margin rose to $1.45 per ton, compared to $0.88 per ton during the same period last year.

Average realization for all tons sold increased 8% to $15.59 per ton, while the average cost across all tons increased approximately 4.7% to $14.14. By region, average realization per ton sold increased 22% in the East to $36.21 and 5% in the West to $7.67, as the company benefited from stronger contract prices in both regions and very attractive margins on limited spot sales in the East.

Rail difficulties resulted in missed shipments in both the East and West, including some of the company's highest margin eastern business. In addition, the company was forced to curtail production during the quarter at the West Elk mine in Colorado and the Black Thunder mine in Wyoming due to high inventory levels stemming from insufficient rail service. Inventory levels increased more than 30% to 9.4 million tons during the year's first half.

Average per-ton operating cost for all tons sold rose approximately 4.7% during the quarter vs. the same period last year. Average per-ton operating cost in the West increased approximately 4.6% to $6.79 due principally to rail-related production constraints as well as higher sales-sensitive costs related to improved realizations. In the East, the average per-ton operating cost increased 16% to $33.29 as a result of lower volumes, higher commodity costs (diesel fuel, explosives and steel), and increased contract mining expenses, as well as higher sales-sensitive costs. In addition, the company incurred higher coal preparation and purchased coal costs associated with an ongoing effort to shift more of its eastern production into the metallurgical market. During the quarter, the company sold approximately 650,000 tons of metallurgical coal, an increase of 70% compared to the same period last year.

"We continue to focus on managing our costs effectively and running our operations in a manner that will enable us to capitalize on opportunities in the marketplace," Leer said. "Arch's operations in both the East and West rank among the most productive and lowest cost in their respective operating regions. With improved rail service and the completion of several small-scale expansion projects in the East, we expect continued margin expansion and increased levels of profitability across all of our operations."

Operating statistics

Coal markets continue to strengthen

During the quarter, spot prices for many coal products rose to their highest levels in many years as an expanding economy boosted power demand; coal-based utilities sought to rebuild rapidly depleting stockpiles; and eastern coal producers struggled to keep pace with demand.

"It is becoming increasingly evident that the fuels with which coal has competed for decades - nuclear, natural gas and hydroelectric - are simply incapable of keeping pace with America's growing demand for power," Leer said. "As a result, domestic coal demand is booming - and the domestic coal market appears to be at the outset of a long and sustained run."

Rapid declines in coal stockpiles at U.S. power plants are one indication of the market's staying power, according to Leer. "Based on an estimated increase in electric output of 2.4% year to date, according to Edison Electric Institute, we expect that the amount of coal in power industry stockpiles will fall to well under 100 million tons by year's end," Leer said. "That should act as a powerful stimulus for an extended period of vigorous demand as utilities seek to rebuild stockpiles at their coal-based power plants, which are increasingly viewed as their most economic, reliable and strategic sources of power."

In addition to strong domestic demand, world coal markets are showing similar signs of strength, boosted by increasing coal consumption in some of the world's fastest growing economies, including China and India, according to Leer. Robust international demand - coupled with a rejuvenated global steel industry - has greatly enhanced the outlook for U.S. coal exports, which are up an estimated four million tons, or 25%, through the end of May.

In addition, sulfur dioxide emissions allowance credits are now trading at over $500 per ton, nearly four times higher than the level just 18 months ago. "Since the passage of the Clean Air Act Amendments of 1990, Arch has pursued focused growth in the nation's three principal low-sulfur coal regions," Leer said. "As a result, we are extremely well positioned to capitalize on the current market environment and the significant premiums being paid for lower sulfur coals."

Development work to commence at Mountain Laurel during third quarter

In July, Arch received the last major permit needed to begin development work on a new longwall mine, located at the Mountain Laurel complex in Logan County, West Virginia. "Arch's extensive reserve base creates many attractive opportunities for profitable growth," Leer said. "We view Mountain Laurel as one of the best undeveloped longwall reserves in the eastern low-sulfur coalfields."

The Mountain Laurel longwall mine is expected to produce five million tons of coal on an annualized basis once it ramps to full production in mid-2007. Initial production should begin in late 2005. The mine's entire output will be available for sale as either a metallurgical coal or a high-quality steam coal, depending on market dynamics at the time. Arch expects to invest approximately $190 million to develop the longwall operation.

"Once development work is completed, we expect Mountain Laurel to become the centerpiece of our eastern operations," Leer said. "It is a unique property that should rank among the most productive and lowest cost operations in the region for many years to come." The start-up of the Mountain Laurel longwall is expected to coincide with the projected depletion of the Mingo Logan longwall reserves in late 2006.

Other recent developments

On July 15, Arch announced that it had signed a definitive agreement to acquire the remaining 35% interest in Canyon Fuel Company. The present value of the purchase price less cash acquired totals approximately $98 million. Canyon Fuel will become a wholly owned subsidiary of Arch Coal following the closing of the transaction, which is expected to occur sometime during the third quarter. "This acquisition solidifies Arch's position as the leading coal producer in the Western Bituminous Region," Leer said. "Demand for western bituminous coal has increased significantly in recent months, as eastern utilities seek alternatives for high-Btu, low-sulfur eastern coals, which remain in short supply. Through the integration of our West Elk mine in Colorado and the Canyon Fuel operations in Utah, we have established a strategic platform that will enable us to compete aggressively for this business."

Arch also continues to pursue the acquisition of Triton Coal Company's North Rochelle mine. As previously announced, the Federal Trade Commission filed a lawsuit in late March 2004 to block the acquisition. Arch defended the transaction in a hearing in U.S. District Court for the District of Columbia that concluded on July 20. The court is expected to render a decision during the third quarter on whether to enjoin the transaction from proceeding. "While we hope for a favorable decision, Arch has incurred certain acquisition-related costs - totaling approximately $12 million through June 30 - that would be expensed immediately should the Triton transaction fail to be consummated," Leer noted.

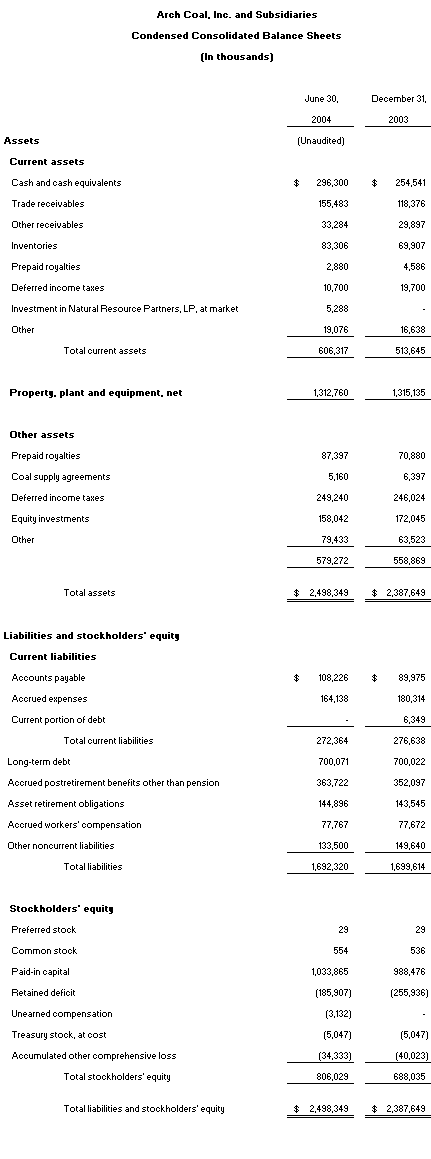

Arch ended the quarter with $296.3 million of cash on its balance sheet. The company plans to use approximately $60 million of that cash to finance the acquisition of Itochu's 35% stake in Canyon Fuel. The remainder - as well as approximately $280 million in capacity under the company's existing revolver - is available to fund other growth initiatives, including the potential acquisition of Triton's North Rochelle mine. In addition, the company's Arch Western subsidiary has an undrawn term loan of $100 million that could be used to fund the potential acquisition of Triton.

Contract activity

Capitalizing on the market's current strength, Arch acted to lock in pricing on a percentage of its unpriced tonnage during the second quarter. The company signed attractive new commitments that increased the percentage of coal already priced for delivery in 2005 from approximately 65% to 75%, and in 2006 from approximately 50% to 60%.

"An increasingly attractive contract portfolio and a significant open market position for future production should lead to significant improvements in our average per-ton realizations across all regions in coming quarters," Leer said.

Looking ahead

Arch expects to record earnings of between $0.15 and $0.25 per share for the third quarter, excluding charges related to the termination of hedge accounting for interest rate swaps, with actual results dependent in large part on rail performance. Rail service is expected to improve as the year progresses, according to Leer.

"Despite rail-related challenges that are incorporated in our third quarter earnings estimate, we expect strong upward momentum in earnings in future periods," Leer said. "The fourth quarter is expected to be our strongest of the year, and we anticipate even greater improvements in earnings next year, when an increasing percentage of our production is expected to reflect recent market conditions."

A conference call concerning second quarter earnings will be webcast live today at 11 a.m. Eastern. The conference call can be accessed via the "investor" section of the Arch Coal Web site (www.archcoal.com).

Arch Coal is one of the nation's largest coal producers, with subsidiary operations in West Virginia, Kentucky, Virginia, Wyoming, Colorado and Utah. Through these operations, Arch Coal provides the fuel for approximately 6% of the electricity generated in the United States.

Forward-Looking Statements: Statements in this press release which are not statements of historical fact are forward-looking statements within the "safe harbor" provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on information currently available to, and expectations and assumptions deemed reasonable by, the company. Because these forward-looking statements are subject to various risks and uncertainties, actual results may differ materially from those projected in the statements. These expectations, assumptions and uncertainties include: the company's expectation of continued growth in the demand for electricity; belief that legislation and regulations relating to the Clean Air Act and the relatively higher costs of competing fuels will increase demand for its compliance and low-sulfur coal; expectation of continued improved market conditions for the price of coal; expectation that the company will continue to have adequate liquidity from its cash flow from operations, together with available borrowings under its credit facilities, to finance the company's working capital needs; a variety of operational, geologic, permitting, labor and weather related factors; and the other risks and uncertainties which are described from time to time in the company's reports filed with the Securities and Exchange Commission.